YouGov Research: Could F1 Put Saudi Arabia Tourism On The Fast Lane?

The third edition of the Saudi Arabian Grand Prix will take place on March 19. The excitement is palpable with authorities even announcing an official holiday for students and employees of schools in Jeddah. Ahead of the race, we dip in YouGov data to understand the impact of the previous editions of the F1 main event in Saudi Arabia on the interested generated in the sport, and how the F1 might aid the country’s tourism ambitions.

Saudi Arabia has indicated that the Saudi Arabian Grand Prix is a key part of its ambitions to open up the country to the outside world. Proliferation of a growth in tourism is earmarked to play a key role in the achievement of the Kingdom’s ‘Vision 2030’ and F1 might help play its part in achieving these goals, YouGov data shows.

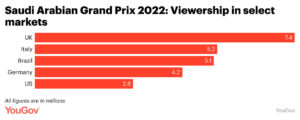

Total global viewership for the 2022 race exceeded 75 million and made a huge splash in key target source markets for the Kingdom. For example, 7.4 million viewers tuned in from the UK, 5.2 million from Italy, 5.1 million from Brazil, 4.2 million in Germany, as did 2.8 million Americans.

According to YouGov analysis, the total broadcast and digital streaming value to Saudi Arabia from postcard shots and brand exposure to key local sponsors reached $75.5m gross advertising and $34.9m net sponsorship media value (when applying YouGov Sport’s Brand Impact Score).

Using YouGov DestinationIndex, we can go one step further to look at whether this significant media exposure translated to a change in perception amongst consumers, including F1 fans in various markets becoming more open to the idea of Saudi Arabia as a tourist destination. The data shows that in each of the UK, US and Germany, F1 fans are likely to hold a better impression of Saudi Arabia as a tourist destination. “F1 fans” in this context refers to those who say that motorsport is one of their top interests or that they are somewhat interested in it.

The Impression scores for Saudi Arabia as a destination among UK’s F1 fans was four points higher than among the overall population between November 1, 2021 to April 30, 2022. This six-month period encompasses both the December 2021 Grand Prix event in Jeddah as well as the March 2022 race.

Among Americans, Impression scores were 12 points higher in the F1 fans group compared to the overall population. Moreover, while 2% of all Americans said they would consider a vacation in Saudi Arabia, that share was twice as high (4%) among F1 fans. Among the group of F1 fans who said that the event is among their top interests, the share of those who said they would consider vacationing in Saudi Arabia tripled to 6%.

Among German F1 fans, Impression scores towards the Saudi Arabia as a destination was about 6 points higher than among the overall population. The Impression score also rose 2 points among F1 fans in the November to April window compared to the previous six-month period.

While the relative uplift in Consideration scores for Saudi Arabia are somewhat negligible among F1 fans in the UK and Germany, the difference in Impression scores might be an indication that they are warming up to the idea of a visit there.

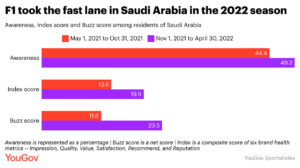

But it’s not only the Kingdom’s tourism that stands to benefit. F1’s goals of expanding the fan base in new territories might be bearing fruit too. In the six-month period between November 1, 2021 to April 30, 2023, residents of Saudi Arabia grew more aware of the event compared to the previous six months (1 May, 2021 to October 31, 2021). The Awareness scores grew from 44% to 49%, making it the sports property with the third-highest Awareness score, behind only the FIFA Football World Cup and the FIFA Club World Cup.

F1s Index score, which is a composite measure of six brand health metrics (Impression, Quality, Value, Satisfaction, Recommend, and Reputation), rose from 13.6 to 19.9. During the same period, an even higher uplift in Index score (+7.2) was registered among those aged 18-34.

In the same period, Buzz score grew nearly 12 points to 23.5. The Buzz score is a measure of difference between the percentage of respondents hearing positive news and the percentage hearing negative news about an event in the previous two weeks.

Who are Saudi Arabia’s F1 fans?

YouGov Profiles equips marketers with the ability to accurately frame a picture of various audiences based on a vast array of demographic and psychographic data points. Looking at F1 fans (those who are interested in the event) in the Kingdom, females make up two-fifths of the fan base (39% vs 61% males).

About two-fifths of these fans are aged between 18-24 (19%) and a quarter are aged between 25-34 (26%). Just under a third fall in the 35-44 age bracket (31%), which is four percentage points higher than their share in the overall population (27%). The share of those aged 45 and above is lower compared to their share in the overall Saudi Arabia population. About a quarter of F1 fans are aged 45+ as opposed to three in ten of all Saudi residents (25% vs 29%).

Nearly two-fifths of F1 fans reside in Riyadh (38%) and a quarter of them are from Jeddah (26%).

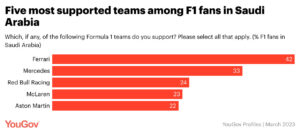

Ferrari is the most popular team in Saudi Arabia, with two-fifths of fans naming it one of their favourites (42%). A third of F1 fans also support Mercedes (33%). Red Bull Racing (24%), McLaren (23%) and Aston Martin (22%) also enjoy substantial support.

Marketers can also benefit from a wealth of sponsorship attitudes captured by YouGov Profiles. More than half of F1 fans in the Kingdom say they love seeing “cool sponsors” associate with their favourite teams (55%). A similar proportion of them “take notice of who sponsors the sporting events” they watch (55%). Particularly encouraging is the fact that nearly half of them say they “like to support my teams by buying products from their sponsors” (48%).

In addition to the sponsorship statements, marketers can use other types of data points to build a detailed portrait of an audience. Let’s look at some statements that help create a better-rounded picture. F1 fans are 12 percentage points likelier than the overall population to say they like to go to trendy restaurants (60% vs 48%). They are 10 percentage points likelier to say they are willing to travel long distances to visit new attractions (59% vs 48%). They are also more inclined to trust products recommended by celebrities or influencers (47% vs 37%) and to prefer a meaningful connection with brands over a short-term connection that will fade away (49% vs 40%).

Email: info@cyber-gear.com

Email: info@cyber-gear.com