Residential Sales Volumes Recover To Pre-Covid Levels Across Saudi Arabia

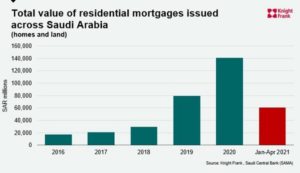

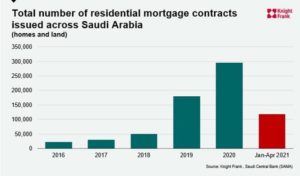

The number of residential mortgages issued in Saudi Arabia during April has hit a five-year high, according to Global property consultants, Knight Frank.

Faisal Durrani, Head of Middle East Research at Knight Frank notes: “The vast apparatus that is Vision 2030 is percolating through to the Kingdom’s residential market, with rising residential mortgage rates, helping the government to realise its ambitions of higher home ownership rates. Indeed at 60% at present, the government has already surpassed its 2020 target by 8% and is well on course to achieving 70% home ownership by 2030.”

Knight Frank notes that a number of key policy initiatives are underpinning the resilience of residential sales activity, which has seen sales volumes return to pre-Covid levels.

“Initiatives such as Sakani, which was first launched in 2017 to boost home ownership through a landmark housing allocation programme, plus the Wafi programme that allows off-plan sales, are transforming Saudi Arabia’s residential landscape. This coupled with the kingdom’s tremendous home building programme, which aims to add over 500,000 units to Riyadh’s housing stock by 2030 alone – that’s just 100,000 units less than Dubai’s total current housing stock – means Saudi nationals are able to access the housing ladder in record numbers.

“Indeed, at 115,000 transactions, sales volumes between January and May are on par with the same period in 2019 and are in fact 49% higher than January to May 2018. Home buyers and lenders are clearly feeling more confident about life as the post-Covid recovery starts to bed in”, Durrani explained.

Knight Frank highlights that 1.1 million families have benefitted from the Sakani program since its launch five years ago.

Email: info@cyber-gear.com

Email: info@cyber-gear.com