Refinitiv: Global Islamic Finance Industry Expected To Reach US$5.9 Trillion By 2026

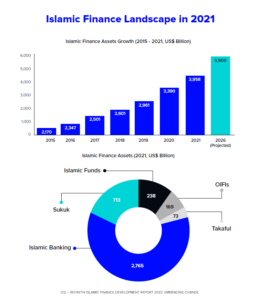

The global Islamic finance industry is expected to reach US$5.9 trillion by 2026 from US$4 trillion in 2021 driven by Islamic banks and Sukuks according to the 2022 Islamic Finance Development Indicator (IFDI) released by Refinitiv, a (LSEG) London Stock Exchange Group Business, and the Islamic Corporation for the Development of the Private Sector (ICD).

The indicator is a composite weighted index that measures the overall development of the Islamic finance industry.The data is comprehensively gathered from a universe of 136 countries and measured across more than 10 key metrics, including knowledge, governance, sustainability, and awareness.

Malaysia led the IFDI list this year with a score of 113, followed by Saudi Arabia (74), Indonesia (61), Bahrain (59), Kuwait (59), UAE (52), Oman (48), Pakistan (43), Qatar (38) and Bangladesh (36). The Gulf Cooperation Council (GCC) has the highest average score while the United States and countries in Europe have the lowest.

According to the indicator, Islamic banking currently holds 70 percent of the global Islamic finance industry while Sukuk’s grew by 14% in 2021 to US$713 billion. Islamic funds, the third biggest sector, saw standout growth of 34% to US$238 billion worth of assets under management in 2021.

Eng. Hani Salem Sonbol,Acting CEO Islamic Corporation of Development of Private Sector, said: “We are optimistic for the continued double-digit growth of the global Islamic finance industry because of the prevailing positive developments we see in new and emerging markets such as in Central Asia and North Africa. The developments in these regions especially with regards to regulations and capacity-building have been years in the making, facilitated greatly by organisations such as the ICD.”

“The big and more mature Islamic finance markets such as the six countries of the GCC, Malaysia, and Indonesia, continue to strengthen their industries and lead with developments and innovations in segments like Islamic FinTech, regulations and sustainability,” Sonbol added.

Mustafa Adil, Head of Islamic Finance, LSEG, said: “Islamic finance is not exclusive anymore to Islamic or Muslim majority countries. For decades the global industry has benefitted from countries such as the UK’s participation across all the sectors. We are excited that in July 2022 Australia’s first full-fledged Islamic bank received its license to operate demonstrating the continued and increasing appeal of Islamic finance.”

“Looking specifically at Islamic finance, several large-scale national plans and roadmaps will give the industry a boost. These include Afghanistan, Brunei, Indonesia, Indonesia, Kazakhstan, Labuan, Malaysia, Oman, Pakistan, and Saudi Arabia. Key developments across North Africa where Islamic banking and takaful are gaining a lot of traction and growth, will also contribute to the expansion of Islamic finance moving forward,” Adil concluded.

To download a copy of the report, please click here

Email: info@cyber-gear.com

Email: info@cyber-gear.com