Investor Sentiment In GCC Healthcare Sector Remains Strong As Market Value Reaches US$70 Billion

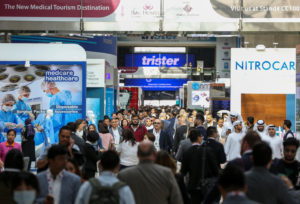

The healthcare investment landscape in the Gulf Cooperation Council (GCC) region was the main focus for the inaugural Healthcare Investment Forum which took place today at Arab Health 2020, on the penultimate day of the four-day showcase in Dubai which ends tomorrow, 30 January.

With the healthcare market in the GCC estimated to be worth US$70 billion, and expected to grow at a compound annual growth rate (CAGR) of 5 percent, healthcare continues to provide strong value opportunities for investors.

Conversation at today’s forum focused on the drivers of change in healthcare investing in the region and offered a platform for discussion on what the future holds for the healthcare investment landscape in the Middle East.

Speaking during this morning’s session, Jad Bitar, Managing Partner and Director, BCG, Dubai, UAE, said: “Although there is enormous room for growth, the GCC is only spending around half of what mature markets spend on healthcare. As such, there are several factors creating investible opportunities in healthcare in the region including underperforming systems and players, shifts in strategic focus such as disease burden and geographic footprint, the outsourcing of operations such as manufacturing and supply chain, as well as capacity build through digitisation and value-based healthcare and the current state of fragmentation in service provision.”

Over the course of today’s Healthcare Investment Forum, attendees were also given an overview of both local and global experiences in investing in healthcare technologies and innovative startup companies. General Manager of International Business at Jawbone Health, Bandar Antabi, shared the companies insights into investing in healthcare tech from a global perspective, while Dr Ihsan Almarzooqi, Managing Director of Glucare in Dubai, highlighted local learnings and experiences in the market.

“Over the past two years in the US alone, digital health startups have raised well over US$10 billion in funding across nearly 1,000 deals, according to data from Pitchbook and Crunchbase. This is hugely indicative of the current focus on optimising healthcare workflows, improving healthcare access and offering lower-cost distribution models. Arab Health is designed to showcase these opportunities as we get set for another strong year for innovation and venture investing in this sector,” commented Ross Williams, Exhibition Director, Arab Health.

In a recent report by Informa Markets, organisers of Arab Health, titled Voice of the Healthcare Industry Market Outlook, respondents shared their experience regarding investment opportunities in the healthcare market in the GCC. The UAE and Saudi Arabia remain the strongest markets in the GCC, both in terms of current performance and in participants’ expressed level of attractiveness for the next two years. The overall outlook of the survey was positive for 2020 globally, with 79.3% of respondents expecting an increase in revenue compared to 2019, and 15.4% expecting a stable performance.

Paul McGrade, former EU policy adviser to two British Prime Ministers and now Senior Counsel at Lexington Communications, one of the UK’s leading strategic consultancies, said: “With Brexit imminent, the UK will be putting increasing effort and resources into growing trade globally, and the Middle East will be an important part of that. The region’s demand for world-class healthcare, and historic links to the UK market, make this a priority sector for growing UK trade.”

Continuing the investment theme, Prince Guillaume of Luxembourg visited Arab Health where he had the opportunity to meet various exhibitors from Luxembourg who were showcasing a range of products at the show.

During the meeting, held at Qasr Al Bahr in Abu Dhabi, His Highness Sheikh Mohamed bin Zayed welcomed Prince Guillaume and his delegation and hoped that the visit would contribute in furthering ties of friendship and cooperation between the UAE and Luxembourg.

Delegates will return to the Healthcare Investment Forum tomorrow (30th January) to hear about private equity investment strategies and cross border collaboration, as well as developing a venture capital (VC) funding strategy around how to deply funding capital in order to maximise the returns on investment.

The final day of the Innov8 Talks agenda will also get underway tomorrow, with eight innovative SME’s and entrepreneurs presenting their latest groundbreaking healthcare ideas to a panel of judges. Some of the companies presenting their pitches include Ampersand Health – the first scientifically validated digital therapy for long term inflammatory conditions; Noul’s AI analysis in diagnostics; and AI-powered health-tech company Prognica.

With 14 conferences, Arab Health Congress is one of the largest CME-accredited multi-track medical conference in the world. Running from 27 – 30 January 2020 at the Dubai World Trade Centre and Conrad Dubai and organised by Informa Markets, more than 400 expert speakers and 5,200 delegates are expected to attend.

Email: info@cyber-gear.com

Email: info@cyber-gear.com