Dubai’s Residential Market Surges With 5.6% Growth In Q1 2023

Dubai’s residential market continues to experience an impressive upward trend, with values increasing by 5.6% in Q1 2023. This marks the 9th consecutive quarter of growth, driven by strong demand for luxury second homes and the city’s emergence as a global luxury hub.

Villas Outperform the Market

Experiencing an average growth of 5.1% between January and March, reaching AED 1,450 psf. In contrast, apartment prices increased by 5.7% to approximately AED 1,230 psf during Q1.

Faisal Durrani, Partner – Head of Middle East Research, explains, “Despite this strong rate of increases, prices still lag the 2014 peak by 15%. Apartments have been slower to recover and still trail the last market peak 7-years ago by 18%. Villas on the other hand have equalled their 2014 peak and remain highly sought, particularly in the upper echelons of the market, with prices now 15% higher than Q1 2022, with even more significant growth in prime neighbourhoods.”

Strong Growth in More Affordable Locations:

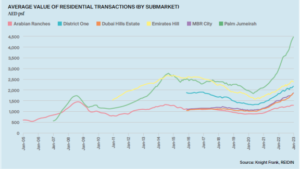

Dubai Hills Estate and Emirates Hills, for instance have experienced sharp increases in prices as domestic buyer demand for larger homes fuels demand, particularly in more affordable inland communities. Dubai Hills Estate saw a 23% increase in apartment prices in the last 12 months, making it one of the strongest gainers in the city.

Palm Jumeirah Emerges as the Top Performer

The Palm Jumeirah has been the city’s star-performing villa market, with prices rising by 14% during Q1 and a 53% growth rate over the last 12 months. Knight Frank’s data reveals that villa prices on the iconic Palm Jumeirah have increased by an impressive 126% since the start of the pandemic.

Andrew Cummings, Partner and Head of Prime Residential at Knight Frank says, “The sustained strong demand for luxury homes from the international elite has significantly contributed to the 44% increase in average villa prices across Dubai since January 2020. This level of growth has allowed villa prices to reach the last market peak in 2014, demonstrating Dubai’s emergence as a leading global luxury hub.”

Branded Residential Boom

Branded residential sales have seen a sharp rise since the start of the pandemic, driven by UHNWI demand. Developments such as Baccarat Residences in Downtown Dubai have achieved record prices, highlighting the growing popularity of branded residences in the city.

Dubai Market Outlook for 2023

According to Knight Frank’s report, Dubai’s prime residential market is expected to experience the highest growth rate for any prime residential market globally, with a projected growth of 13.5% in 2023. This growth is supported by a clear demand-supply imbalance and a positive economic backdrop.

Andrew Cummings, Partner and Head of Prime Residential at Knight Frank continues, “The current market conditions, combined with a return to steady and sustainable growth, will instil confidence in homeowners and investors alike.”

Faisal Durrani, Partner – Head of Middle East Research, concluded: “Three-and-a-half years into the current market cycle, overall price growth is moderating as the extraordinary rises registered during the pandemic begin to work their way out of the equation. The bottom line however remains a significant mismatch between demand and supply of luxury homes. This combined with Dubai’s emergence on the global stage as the go-to second homes market continues to drive prices and indeed this is why over the last 12-months, prices have risen by 13%, eclipsing 2022’s 10% growth.”

Email: info@cyber-gear.com

Email: info@cyber-gear.com